Analysts were optimistic – and they were right

Newsletter Archives

- Odyssey’s Quarterly Buyside Newsletter Q1 2021

- Odyssey’s Quarterly Buyside Newsletter Q4 2020

- Odyssey’s Quarterly Buyside Newsletter Q3 2020

- Odyssey’s Quarterly Buyside Newsletter Q2 2020

- Odyssey’s Quarterly Buyside Newsletter Q1 2020

- Odyssey’s Quarterly Buyside Newsletter Q4 2019

- Odysseys Quarterly Buyside Newsletter – Q3 2019

- Odysseys Quarterly Buyside Newsletter – Q2 2019

- Odysseys Quarterly Buyside Newsletter – Q1 2019

- Odysseys Quarterly Buyside Newsletter – Q4 2018

- Odysseys Quarterly Buyside Newsletter – Q3 2018

- Odysseys Quarterly Buyside Newsletter – Q2 2018

- Odyssey’s Quarterly Buyside Newsletter – Q1 2018

- Odyssey’s Quarterly Buyside Newsletter – Q4 2017

- Odyssey’s Quarterly Buyside Newsletter – Q3 2017

- Odyssey’s Quarterly Buyside Newsletter – Q2 2017

- Odyssey’s Quarterly Buyside Newsletter – Q1 2017

- Odyssey’s Quarterly Buyside Newsletter – Q4 2016

- Odyssey’s Quarterly Buyside Newsletter – Q3 2016

- Odyssey’s Quarterly Buyside Newsletter – Q2 2016

In this Newsletter

- 2017 Hedge Fund Bonus Numbers are in

- The Art of Thinking Independently Together

Hiring for diversity of background and diversity of thought

- Hiring non-U.S. Employees

How firms are thinking about visa sponsorship

- The Keys to Differentiation for Private Credit

What firms are doing to use up all that dry powder

- Landing Your Top Choice Candidate

How to get the person you want into their seat

Civilization is the encouragement of differences

– Mahatma Gandhi

As we move into the second quarter of 2018 we tackle how some of the key issues of the day – diversity and immigration – are being tackled in the investment management space. We do a deep-dive into how we see private credit firms growing. As the recruiting market continues to heat up, we share our tips on how to land your number one pick candidate. And we start off with the summary results of our Q1 2018 compensation survey that looked into year-end bonuses.

Happy Spring.

-The Odyssey Search Team

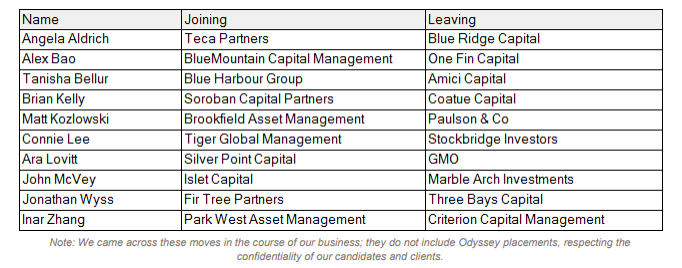

Hedge Fund Moves

Results of Q1 2018 Hedge Fund Investment Professional Compensation Survey

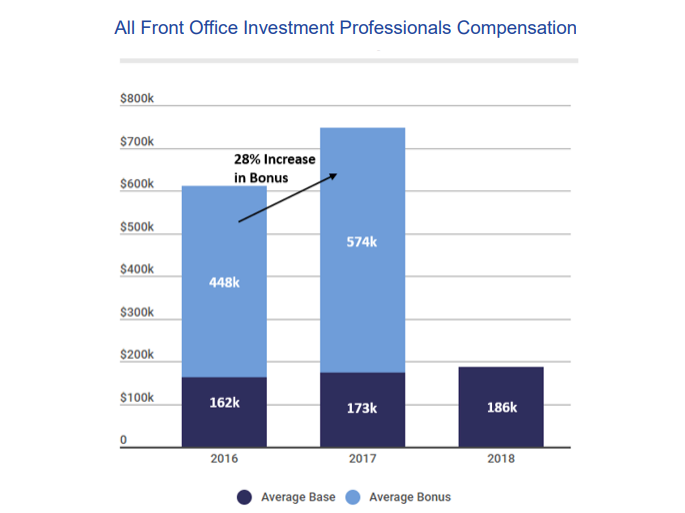

At year-end 2017, hedge fund investment professionals predicted that they were going to receive a 2017 bonus 39% higher than their 2016 bonus (as described in our Q42017 Compensation Report). Surely this was optimistic? A case of wishful thinking before the holidays? Hadn’t they read a newspaper recently about the hedge fund industry and understood what was going on with assets and fees? So earlier this year, we went back and surveyed the same 1,000 people about their actual bonus numbers. The overall findings are now in. Turns out the analysts weren’t off by a lot. The average hedge fund investment professional saw an actual 28% lift in 2017 vs. 2016 year-end bonuses, as illustrated below.

There are three main reasons to explain this:

1. Positive average 2017 fund returns generated significant performance fees in addition to management fees.

2. The return of confidence within hedge funds has heated up the market for top talent between funds, driving up the cost of retaining key investment professionals.

3. The strength of the wider economy has created additional competition, with the fields of technology, private equity and private credit in particular looking to hire similar candidate profiles.

The Art of Thinking Independently Together

That’s how the writer and entrepreneur Malcolm Forbes described diversity. It’s a topic that is receiving a lot of attention, including within the finance industry. First off, what is meant by diversity in financial services? For many, it goes beyond under-represented minorities, though that certainly is a part. One firm, Point72, takes a stab and explains on their website “We’ve attracted talent representing different majors, genders, geographical locations, and nationalities…”

Why make the effort to increase diversity? For many, it just “feels like the right thing to do,” particularly in this era of political division, debates on immigration and the #MeToo movement. There’s also external pressure. Many large LPs are pressuring their managers to increase employee diversity, in order to better represent the demographic make-up of the pension holders or the values of the university endowment. There’s also the desire to perform better. Jeanette Bashford, global HR manager at Bloomberg, was quoted in Bloomberg 8/28/17 saying, “When you have diversity of thought, and all types of education and backgrounds come into play, then you can build amazing products and serve your clients better.” What this means in our space is avoiding some of the group-think that is harming profitability. How does homogeneity of thought make bad business? Some people point to private equity firms chasing the same corporate targets and driving up prices, banks putting downward pressure on their fees because they’re chasing the same limited number of IPO targets, and hedge funds making “consensus trades” that don’t allow them to be differentiated in their return profiles.

As ever, we’d welcome the chance to discuss these topics with you: newsletter@ospsearch.com

The Odyssey Search Team

Share this Newsletter

Early Bird Gets the Worm: Why Financial Services Recruitment Deadlines are Shifting Up

In our analysis, it’s largely the same factors as discussed driving the information of Talent Management programs in the prior article.

Odyssey in the News

About

Odyssey Search Partners is a premier executive search firm founded in 2010 and led by Adam Kahn and Anthony Keizner. We specialize in placing investment professionals in the private equity, hedge fund, family office, and private credit sectors. Our expertise spans all levels of recruitment, from pre-MBA hires to Partners and Portfolio Managers. We approach every search with diversity in mind.

Main Menu

Disclaimer

Headquarters

747 Third Avenue, 37th Floor

New York, NY 10017

Tel: 212-750-5677

info@ospsearch.com

Interested in joining Odyssey?

click here to apply