It’s the growth of the fund, not the size, that pays

Newsletter Archives

- Odyssey’s Quarterly Buyside Newsletter Q1 2021

- Odyssey’s Quarterly Buyside Newsletter Q4 2020

- Odyssey’s Quarterly Buyside Newsletter Q3 2020

- Odyssey’s Quarterly Buyside Newsletter Q2 2020

- Odyssey’s Quarterly Buyside Newsletter Q1 2020

- Odyssey’s Quarterly Buyside Newsletter Q4 2019

- Odysseys Quarterly Buyside Newsletter – Q3 2019

- Odysseys Quarterly Buyside Newsletter – Q2 2019

- Odysseys Quarterly Buyside Newsletter – Q1 2019

- Odysseys Quarterly Buyside Newsletter – Q4 2018

- Odysseys Quarterly Buyside Newsletter – Q3 2018

- Odysseys Quarterly Buyside Newsletter – Q2 2018

- Odyssey’s Quarterly Buyside Newsletter – Q1 2018

- Odyssey’s Quarterly Buyside Newsletter – Q4 2017

- Odyssey’s Quarterly Buyside Newsletter – Q3 2017

- Odyssey’s Quarterly Buyside Newsletter – Q2 2017

- Odyssey’s Quarterly Buyside Newsletter – Q1 2017

- Odyssey’s Quarterly Buyside Newsletter – Q4 2016

- Odyssey’s Quarterly Buyside Newsletter – Q3 2016

- Odyssey’s Quarterly Buyside Newsletter – Q2 2016

In this Newsletter

- 2018 Hedge Fund Compensation Report

- When a Guarantee isn’t Guaranteed

Changes in how offers are made

- Doing Well by Doing Good

An in-depth look at ESG investing

- PE Associate Programs

What’s happening to the 2 year program and how that’s affecting hiring

- Trends in Private Markets

What’s driving industry evolution

With Great Power comes Great Responsibility

– Voltaire

In this Q3 edition, we take a hard look at compensation, examining the findings in our Hedge Fund Compensation Report and analyzing the structure of guaranteed bonuses. We also tackle the evolving thinking about how dollars can do good in the world, through the rise of ESG investing. On the private side, we examine how Private Equity Associate programs are evolving, and the latest trends in private markets investing. Enjoy the Summer

-The Odyssey Search Team

Hedge Fund Moves

Summary of 2018 Hedge Fund Compensation Report

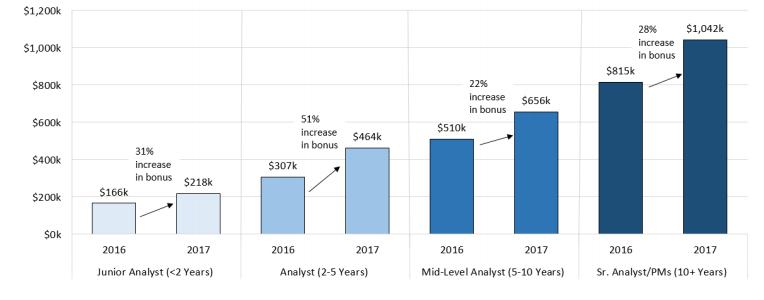

“What do I have to pay these days to keep my best people?” We’ve been hearing that question a lot lately. And we hear a lot of different answers. Some funds with performance and asset issues seem to have distributed weak bonuses, yet on the other hand, there are still rumors about Joey Analyst at XYZ Capital getting a bonus of several million dollars. So now that the dust has settled on the 2017 bonus payouts, we at Odyssey again approached the hedge fund community to straighten out the facts. We surveyed over 500 investment professionals, and their responses help clarify exactly who got paid what, and which factors helped determine those outcomes. Recalling our Fall 2017 survey, expectations were high given the strong returns across the board for capital markets, particularly the hedge fund space. In that survey, we noted that HF investment professionals were expecting an average increase of 39% YoY for their year-end bonuses. While the numbers didn’t quite meet those lofty expectations, the hedge fund industry’s 2017 bonus payouts did indeed rise dramatically when compared with 2016’s figures. The average year-end 2017 bonus was $574,000, compared with $448,000 for 2016; a 28% increase. The key driver behind a firm’s bonus pool was fund performance, which once again turned out to be a far more significant metric than fund size. Hedge funds that were up 5%+ in 2017 distributed bonus payouts 33% greater than those of their peers who sat below that benchmark. In terms of fund size, those with AUM over $5B offered bonuses 14% greater than their peers with less than $1B in AUM (and there was no significant correlation between fund size and performance.) In terms of payout by position, the Junior Analyst and Analyst levels saw the largest percentage increase in bonus payments, followed by Junior Analysts. These increases were higher than those seen at the Mid and Senior levels (though of course, the actual dollar amounts awarded to these more experienced investors were much greater.)

Additionally, in our Comp Report we show how senior investors in equities were rewarded more than their colleagues in credit or event-driven, and how professionals at long-onlys received a fraction of the average bonus awarded to their colleagues at long/short funds. 3 So how were these Bonuses received?

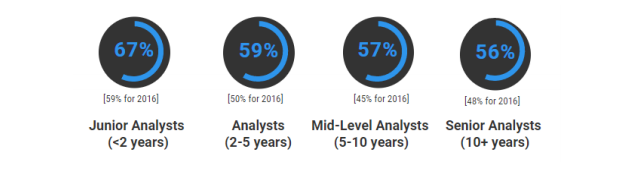

For a second straight year, we asked Analysts how satisfied they felt with their compensation packages. We used a scale of 0 to 100. As the chart below indicates, all groups experienced a minimum 8% increase in their satisfaction levels when compared to perceptions about 2016 bonuses. For the second straight year, Juniors felt the most satisfied, given their healthy bonus packages coupled with the overall strength of the market (youthful enthusiasm likely also plays a factor). Senior Analysts/PMs felt relatively less exhilaration after their bonus payouts, given they experienced the largest gap between expectation and result. In our Fall 2017 survey, the Senior Analysts/PM predicted a massive 70% increase in their

year-end bonus, and so their average 28% increase looks quite paltry in comparison. % of Respondents at Each Level “Satisfied/Very Satisfied” with their Total Compensation in 2017

As ever, we’d welcome the chance to discuss these topics with you: newsletter@ospsearch.com

The Odyssey Search Team

Share this Newsletter

2019 Compensation Data How did hedge fund investment professionals actually fare at year-end?

The results of our 2019 HF compensation survey are in. As a reminder, this is a survey we’ve conducted twice a year for the last several years..

Odyssey in the News

About

Odyssey Search Partners is a premier executive search firm founded in 2010 and led by Adam Kahn and Anthony Keizner. We specialize in placing investment professionals in the private equity, hedge fund, family office, and private credit sectors. Our expertise spans all levels of recruitment, from pre-MBA hires to Partners and Portfolio Managers. We approach every search with diversity in mind.

Main Menu

Disclaimer

Headquarters

747 Third Avenue, 37th Floor

New York, NY 10017

Tel: 212-750-5677

info@ospsearch.com

Interested in joining Odyssey?

click here to apply