How confident are HF, PE and Private Credit analysts?

Newsletter Archives

- Odyssey’s Quarterly Buyside Newsletter Q1 2021

- Odyssey’s Quarterly Buyside Newsletter Q4 2020

- Odyssey’s Quarterly Buyside Newsletter Q3 2020

- Odyssey’s Quarterly Buyside Newsletter Q2 2020

- Odyssey’s Quarterly Buyside Newsletter Q1 2020

- Odyssey’s Quarterly Buyside Newsletter Q4 2019

- Odysseys Quarterly Buyside Newsletter – Q3 2019

- Odysseys Quarterly Buyside Newsletter – Q2 2019

- Odysseys Quarterly Buyside Newsletter – Q1 2019

- Odysseys Quarterly Buyside Newsletter – Q4 2018

- Odysseys Quarterly Buyside Newsletter – Q3 2018

- Odysseys Quarterly Buyside Newsletter – Q2 2018

- Odyssey’s Quarterly Buyside Newsletter – Q1 2018

- Odyssey’s Quarterly Buyside Newsletter – Q4 2017

- Odyssey’s Quarterly Buyside Newsletter – Q3 2017

- Odyssey’s Quarterly Buyside Newsletter – Q2 2017

- Odyssey’s Quarterly Buyside Newsletter – Q1 2017

- Odyssey’s Quarterly Buyside Newsletter – Q4 2016

- Odyssey’s Quarterly Buyside Newsletter – Q3 2016

- Odyssey’s Quarterly Buyside Newsletter – Q2 2016

In this Newsletter

- 2018 Compensation Expectations Survey

- MBA Recruitment

The changing nature of Business School hiring

- NYC’s Compensation

Law One year in

- Growing Private Market Funds

Ways to scale AUM

An investment in knowledge pays the best interest

– Benjamin Franklin

As we move into the year-end, we provide compensation expectation data which we hope proves valuable in what’s been a volatile and confounding year for many. Record profits at the investment banks, helped by a higher number of deals and tax cuts kicking in, have seen more sell-side hiring activity while things have slowed at the asset managers who have suffered asset outflows and declining stock prices. We’ve seen historical fervor for investment banking analysts, as the private equity on-cycle hiring process just kicked off on October 27th, the earliest it’s ever started. We’ve also noted more interest into how the MBA fits into hiring plans and employee development, and we dig into the data around this. Continuing on the compensation topic, we look at the effects

caused by last year’s legal restrictions on requesting compensation data from interview candidates. Finally, as private funds continue to scale, we share what we’re seeing and how this is affecting the market for talent. Here’s to a successful last final quarter of 2018.

The Odyssey Search Team

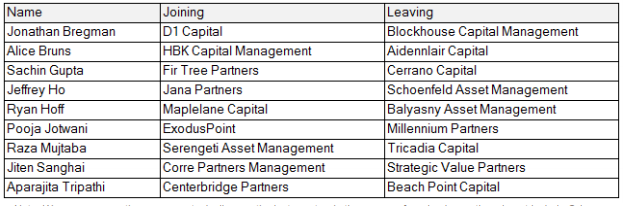

Hedge Fund Moves

The Odyssey Search Partners 2018 Compensation Survey – Initial Findings

As we head into the season of bonus deliberations, we want to share the initial findings of our Investment Professional Compensation Survey. To clarify, in our last Newsletter we reported what actual 2017 year end bonuses had been, whereas this is based on a recent survey to test sentiment about year-end bonus expectations. We surveyed over 1300 investment professionals to ask about their current compensation, and their expectations for year-end. The headline is that investment professionals are still bullish about their prospects for significant year-end bonuses. This was a little surprising against the current backdrop of stock market volatility, significant hedge funds closures and continued interest rate rises – but confidence isn’t something these folks usually lack! As a caveat though, the tough October we’ve just experienced may now be tempering expectations. We break down the populations into Hedge Funds, Private Equity and Private Credit. In each asset class, we surveyed over 400 respondents in September and October 2018 at the junior, mid and senior levels on their past, current, and expected compensation levels (both base and bonus). We’re still compiling the full results but here is a snap shot:

Hedge Funds

- 2018’s mean base salary is $181k, 6% higher than 2017’s actual mean base salary of $171k

- Meanwhile, 2018’s average expected bonuses was $350k, a 17% jump from 2017’s average bonus of $299k

- The 17% average expected bonus increase stands in contrast to this time last year, when the same

population was expecting a 39% increase - Only 19% of respondents expected a decrease in 2018 total compensation relative to 2017

Private Equity

- Across the entire industry, 2017’s average base salary of $164k ticked up to $182k in 2018

- 2017’s average year-end cash bonus was $204k, and in 2018 PE professionals are expecting an average bonus of $229k, a 12% increase (we will break these absolute numbers out by levels in our full Report: given the organization pyramid structure, these numbers reflect more Associate bonuses outweighing those from Principals and more senior PE investors)

- Controlling for fund size, professionals at funds in the <$500M range expect a 14% higher bonus ($175k vs. $154k), whereas those in the >$5B fund group are expecting a much more modest 2%

- Those at Middle Market funds are expecting 12% bonus increases, from $197k actual bonuses to $220k average expected bonus

Private Credit

- As we describer later in the Private Markets article, there continues to be strong demand for the product from institutional investors. The sheer amount of capital raised has produced a highly competitive environment for talent

- This is reflected in the compensation expectations we saw in the survey. However interestingly, Private Credit professionals’ expectations on compensation increases are a little more muted compared to the Hedge Fund and Private Equity space. This is the case on both a percent and

absolute dollar basis. Some details follow:

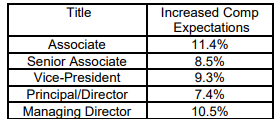

By seniority, at the high end of the expectation range were Associates with expectations of an 11.4% increase. It comes as no surprise that the Associate class is the most optimistic. Simply put, they have the most career alternatives and thus firms feel the need to pay them more in line with market averages across PE, HF and Banking, which have all seen increasing Associate compensation.

Another interesting finding is that the current compensation satisfaction rate sits at 62.9% for all professionals. Again, Associates lead the way, as 66.4% were happy with their current compensation. Though it’s perhaps intuitive that those expecting the highest bonus bumps are the happiest with their compensation!

More details on all these asset classes will be available in our forthcoming compensation surveys, to be shortly released to clients

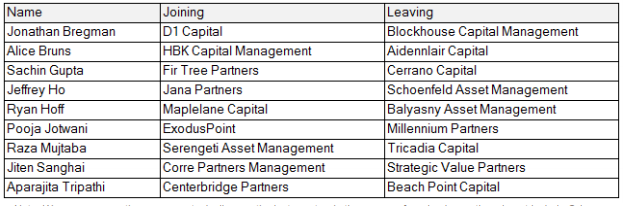

Private Equity Moves

The Evolving Nature of MBA Recruitment

Financial services hiring continues to evolve; one aspect being the role of the BA. We’ve heard some pretty extreme statements from firms and candidates alike in recent years, such as “no-one’s going to b-school anymore” and “MBAs don’t want to join investment firms, they want to run startups.” Indebtedness is a real issue and the latest Department of Education data shows that MBA students took out on average $65,000 in loans, which is not surprising given a top-tier 2 year program now costs over $200k (data from WSJ 9/6/18)…

Financial services hiring continues to evolve; one aspect being the role of the BA. We’ve heard some pretty extreme statements from firms and candidates alike in recent years, such as “no-one’s going to b-school anymore” and “MBAs don’t want to join investment firms, they want to run startups.” Indebtedness is a real issue and the latest Department of Education data shows that MBA students took out on average $65,000 in loans, which is not surprising given a top-tier 2 year program now costs over $200k (data from WSJ 9/6/18)…

As ever, we’d welcome the chance to discuss these topics with you: newsletter@ospsearch.com

The Odyssey Search Team

Share this Newsletter

2019 Compensation Data How did hedge fund investment professionals actually fare at year-end?

The results of our 2019 HF compensation survey are in. As a reminder, this is a survey we’ve conducted twice a year for the last several years..

Odyssey in the News

About

Odyssey Search Partners is a premier executive search firm founded in 2010 and led by Adam Kahn and Anthony Keizner. We specialize in placing investment professionals in the private equity, hedge fund, family office, and private credit sectors. Our expertise spans all levels of recruitment, from pre-MBA hires to Partners and Portfolio Managers. We approach every search with diversity in mind.

Main Menu

Disclaimer

Headquarters

747 Third Avenue, 37th Floor

New York, NY 10017

Tel: 212-750-5677

info@ospsearch.com

Interested in joining Odyssey?

click here to apply